15 Oct Benefits Insights: Life Event Quick Reference Guide

Introduction

You should always elect benefits during open enrollment to ensure you get the coverage you need. However, once you make your elections through a cafeteria or Section 125 plan, you are unable to change your elections until the plan year ends. But sometimes qualified life events occur, allowing you to change your elections outside of the standard enrollment period.

This quick reference guide provides an overview of qualifying life events. It is meant for informational use only and should not be construed as legal advice. For more information about qualifying life events, please talk to HR.

How Do I Qualify?

While you are generally only allowed to change your benefits elections during the open enrollment period each year, certain life events provide an exception. Those life events allow you to change your benefits elections in the middle of the plan year if certain requirements are met.

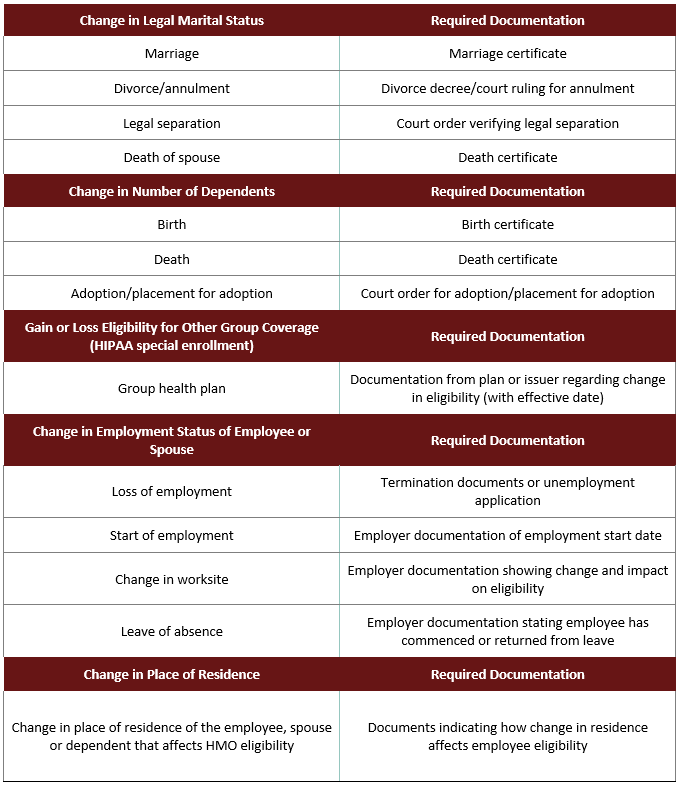

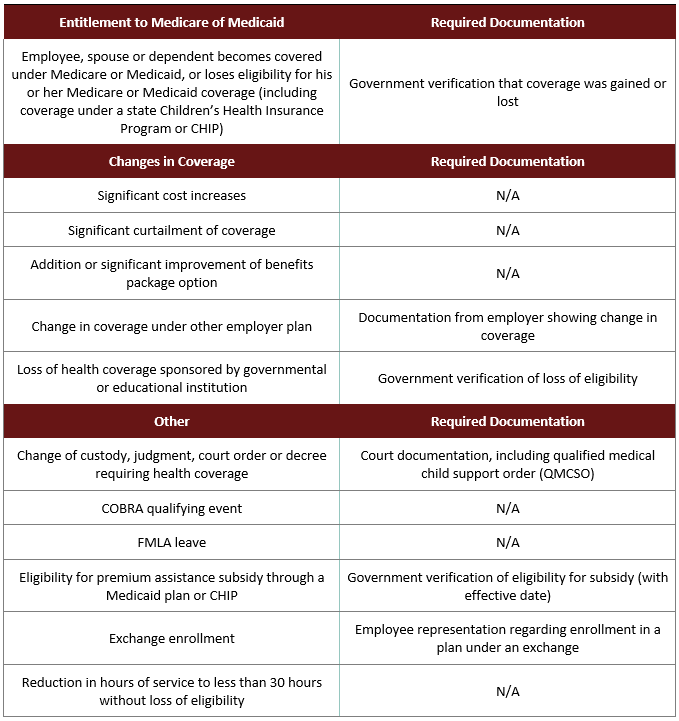

Qualified life events depend on a specific plan’s terms, but some common examples can be found below:

- Change in status (e.g., marital status, number of dependents and employment status)

- Significant cost changes

- Significant curtailment of coverage

- Change in coverage under other employer’s plan

- Addition or significant improvement of benefits package option

- FMLA leaves of absence

- COBRA qualifying events

- HIPAA special enrollment events

- Medicare or Medicaid entitlement

Review the reference chart below for qualifying life events and required documentation.

How Can I Change My Elections Mid-Year?

Outside of open enrollment, you typically cannot make midyear benefit changes unless you experience a qualified life event. To change your elections midyear:

- You must experience a midyear election change event recognized by the IRS.

- The cafeteria plan must permit midyear election changes for that event.

- Your requested change must be consistent with the midyear election change event.

If you believe you’ve experienced a qualifying life event, contact your HR manager. He or she will help you determine if you’ve experienced a qualifying life event or your plan allows for a mid-year benefits change.

Conclusion

Typically, open enrollment is the short period of time when you can enroll in or make changes to your employee benefits selection. Outside of open enrollment, you often cannot make changes to your benefits until the next open enrollment period.

One exception to this rule is if you experience a life-changing qualifying event that would trigger a special enrollment period. Events such as getting married or divorced, having or adopting children, or losing eligibility for other health coverage can trigger special enrollment rights. If you believe that you’ve experienced a qualifying life event, reach out to your HR manager. Together, you can determine if you are eligible to make midyear benefit changes under your plan design.

Be sure to carefully review plan documents during open enrollment to choose the best benefits offerings for you. If possible, consider future life events before choosing your benefits elections during open enrollment to make sure they align with your future goals.

Sorry, the comment form is closed at this time.